How Do I Fill Out my Tax Information?

Songtrust must have it on file to fulfill IRS requirements.

In order to pay out your royalties, we are legally obligated to obtain your tax identification information — a W-9, W-8, 8-BEN, etc — or tax ID number. This is strictly enforced by the International Revenue Service (IRS) to track income. We are legally unable to pay you unless we have this information.

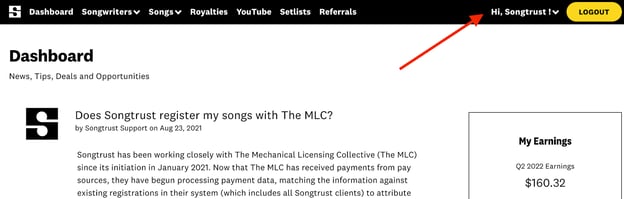

This information, along with an updated address, must be completed under the "Payment & Tax" section, found in the upper right-hand drop-down menu, so we can pay out your royalties.

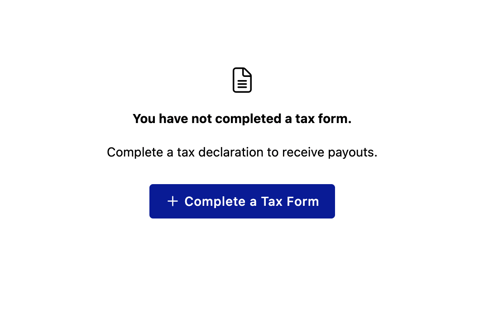

Click “Complete a Tax Form” to continue. You’ll see this button even if you’ve already submitted a tax document previously.

This section begins with the below screen. Follow the instructions to complete and submit your tax form.

.png?width=624&height=367&name=pasted%20image%200%20(1).png)

Tax documents cannot be edited once submitted, so be sure to double-check your information before submitting. If you have made a mistake on an already submitted document, please submit a new one which will void the old version.

Any further issues related to your tax documents, please use our Support Form to submit a ticket and reach our Client Services Team. You can find this form by logging into your account and finding the link on your client dashboard.

Want to keep up with Songtrust for frequent music and publishing updates?

Follow us @songtrust

Subscribe to our Newsletter

Visit the Songtrust Blog