How Do I Update My Mailing Address?

You can make any updates in the "Payment & Tax" section of your account.

Having an updated mailing address is essential, especially as it relates to your end-of-year tax forms. To update the mailing address on tax documentation, begin by logging in to your Songtrust account.

1. Click Payment & Tax from the upper right-hand dropdown menu.

.png?width=233&height=213&name=Untitled%20(1).png)

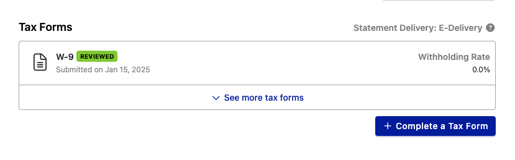

You can also check or change your tax statement delivery method here. If you need to change it, click the ? icon next to your delivery method and follow the instructions.

Statement Delivery Methods

-

E-Delivery: Access tax forms digitally via your Songtrust account or email.

-

Postal Mail: A paper copy of your 1099 or 1042-S will be mailed to the address you submitted in your most recent tax form.

Important Notes

-

If you chose postal mail, you will receive a digital PDF copy in addition to the physical copy you receive. Once 1099s and 1042-S forms are released, you will receive an email confirmation.

-

1099s will be available to you no later than the IRS deadline of January 31st each year.

-

E-delivery consent stays active unless withdrawn.

-

Tax forms remain accessible in your account until October 15th of the following year.

-

For e-delivered forms, ensure you have a device with internet and PDF capability.

Thanks for reading. Please rate the article below.

Want to keep up with Songtrust for frequent music and publishing updates?

Follow us @songtrust

Subscribe to our Newsletter

Visit the Songtrust Blog