How do I know if my tax documentation/payment method are set up for payouts?

Confirm if you're payable for each quarter's payout by checking the following statuses.

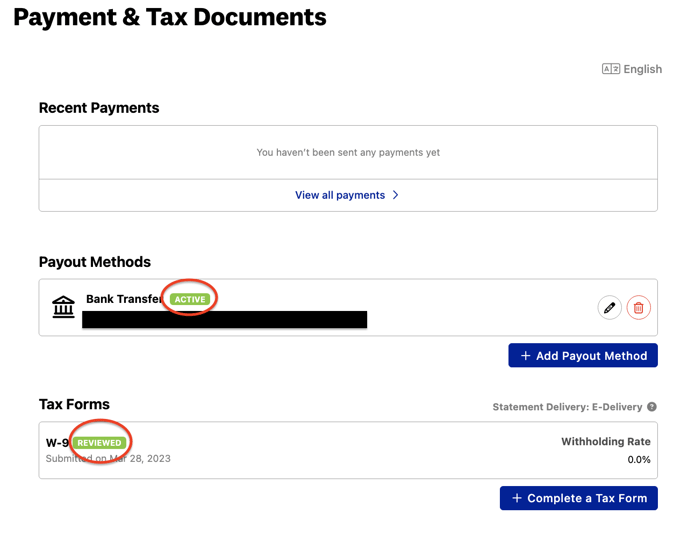

The Payment & Tax section of your account will always be able to confirm whether you are payable or not. To navigate to this section, you will go to Hi, [Name]--> Payment & Tax.

You will be considered payable for each quarterly royalty payout if your payment method is set to Active and your tax form is listed as Reviewed.

Songtrust pays out each quarter's earnings at the end of the following quarter in a set schedule. As an example, if you earned royalties in Q2 (April - June), you'll be paid out at the end of Q3 (September). A few more things to keep in mind and to review on your own account:

1. Tax Information: Songtrust is only authorized to payout clients who have a completed, accurate tax document uploaded into their account. You can check this if you go to Hi, (Your Name) > Payment & Tax Information in your account.

2. Payout Minimum: A payout will occur when your earnings meet a threshold of $25. Any payments below the threshold will be distributed in a future payment once the threshold has been met.

3. Payments: Your royalties will be paid out to you during our quarterly schedule if you have set up your preferred payout method in our Payment & Tax Information section in your account. You'll receive an email notification when our quarterly distribution happens and it'll give you a timeline of when your royalties should arrive based on your payment method.